Crossing Frontiers in electricity prIce forecasTing (CrossFIT)

Grant no.: NCN 2018/30/A/HS4/00444

Funding agency: National Science Centre (NCN), Poland

Funding scheme: MAESTRO

Funding period: 1.07.2019-30.06.2024 (60 months), extended to 30.06.2026 (84 months; due to COVID-19)

Budget: 2 961 200 PLN

Title in Polish: Przekraczanie granic w prognozowaniu cen energii elektrycznej (CrossFIT)

Research team:

Principal Investigator (Kierownik):

Senior Investigators (Główni wykonawcy):

- Katarzyna Maciejowska (1.07.2019-30.06.2020)

- Dimitris Sotiros (1.10.2020-30.06.2021)

- Florian Ziel (1.07.2021-28.02.2023)

- Bartosz Uniejewski (1.10.2023-31.12.2024)

Post-docs

- Arkadiusz Jędrzejewski (1.03.2020-28.02.2022)

- Kaja Bilińska (1.11.2024-30.06.2025)

Investigators (Wykonawcy):

- Katarzyna Chęć

(1.10.2023-30.06.2025)

(1.10.2023-30.06.2025) - Maciej Doniec

(1.10.2023-31.01.2024)

(1.10.2023-31.01.2024) - Arkadiusz Lipiecki

(1.10.2023-30.06.2025)

(1.10.2023-30.06.2025) - Grzegorz Marcjasz

(1.10.2019-30.09.2023)

(1.10.2019-30.09.2023) - Weronika Nitka

(1.10.2019-31.12.2023, 1.07.2024-31.12.2024)

(1.10.2019-31.12.2023, 1.07.2024-31.12.2024) - Bartosz Uniejewski

(1.10.2019-30.09.2023)

(1.10.2019-30.09.2023)

Collaborators (Współpracownicy):

- Cristian Challu (Carnegie Mellon University, Pittsburgh, USA)

- David Linek (PWr)

- Tao Hong (UNCC, Charlotte, USA)

- Christopher Kath (RWE Supply & Trading GmbH, Essen, D)

- Jesus Lago (Amazon, NL; Delft UT, NL)

- Kin Gutierrez Olivares (Carnegie Mellon University, Pittsburgh, USA)

- Stefan Trück (MQ, Sydney, AUS)

- Hamidreza (Hamid) Zareipour (University of Calgary, CAN)

![]() – Ph.D. / M.Sc. / B.Sc. student

– Ph.D. / M.Sc. / B.Sc. student

Aims and scope:

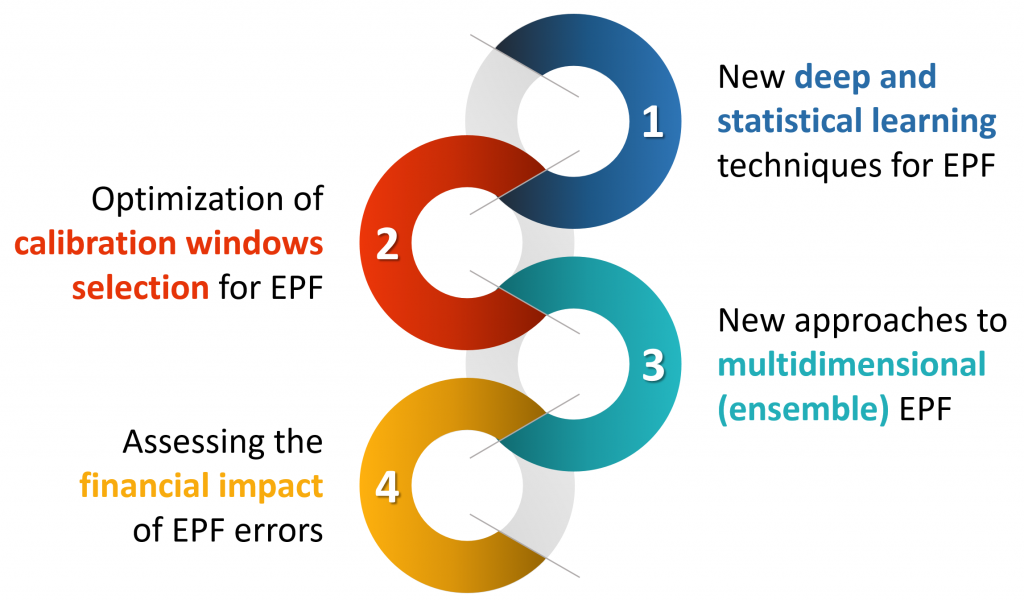

Over the last two decades price forecasts have become fundamental inputs to energy companies’ decision-making mechanisms and a variety of methods have been tried for electricity price forecasting (EPF). However, the unprecedented expansion of renewable generation and active demand side management on one hand, and machine learning advances as well as the increase of computational power on the other, have recently provided the impulse and – the much needed – technical possibilities to cross the frontiers of today’s electricity price forecasting. It is exactly the aim of the CrossFIT project to go beyond the state-of-the-art by carrying out the following four tasks:

Tasks:

- Development and validation of new techniques for electricity price forecasting based on deep and statistical learning.

- Optimization of calibration window(s) selection for short-term forecasting with statistical and computational intelligence methods.

- Development and validation of approaches to multidimensional (ensemble) electricity price forecasting.

- Development of measures and procedures for assessing the financial impact of electricity price forecasting errors.

Expected impact:

The CrossFIT project is interdisciplinary in nature and will, in particular, contribute to: (i) computational statistics and computer science by developing efficient EPF algorithms that use deep or statistical learning and utilize carefully selected calibration windows, (ii) econometrics by analyzing existing and developing new methods for computing and evaluating ensemble forecasts, (iii) finance by proposing measures that assess the financial impact of EPF errors, and (iv) electrical engineering by virtue of the analyzed processes. From the utilitarian point of view it will contribute to improving forecasting and risk management practices in the energy sector and in the longer run it may contribute to improving the financial stability of the firms operating in the power market and the national energy security.

Publications:

Peer-reviewed articles in JCR-listed journals

2025 (3+), 2024 (4), 2023 (4), 2022 (2), 2021 (3), 2020 (2)

K. Chęć, B. Uniejewski, R. Weron (2025) Extrapolating the long-term seasonal component of electricity prices for forecasting in the day-ahead market, Journal of Commodity Markets 37, 100449 (doi: 10.1016/j.jcomm.2024.100449). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2404.html

K. Chęć, B. Uniejewski, R. Weron (2025) Extrapolating the long-term seasonal component of electricity prices for forecasting in the day-ahead market, Journal of Commodity Markets 37, 100449 (doi: 10.1016/j.jcomm.2024.100449). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2404.html A. Lipiecki, R. Weron (2025) PostForecasts.jl: A Julia package for probabilistic forecasting by postprocessing point predictions, SoftwareX 31, 102200

A. Lipiecki, R. Weron (2025) PostForecasts.jl: A Julia package for probabilistic forecasting by postprocessing point predictions, SoftwareX 31, 102200  (doi: 10.1016/j.softx.2025.102200). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2502.html

(doi: 10.1016/j.softx.2025.102200). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2502.html T. Serafin, R. Weron (2025) Loss functions in regression models: Impact on profits and risk in day-ahead electricity trading, Energy Economics 148, 108596

T. Serafin, R. Weron (2025) Loss functions in regression models: Impact on profits and risk in day-ahead electricity trading, Energy Economics 148, 108596  (doi: 10.1016/j.eneco.2025.108596). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2403.html

(doi: 10.1016/j.eneco.2025.108596). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2403.html- A. Lipiecki, B. Uniejewski, R. Weron (2024) Postprocessing of point predictions for probabilistic forecasting of day-ahead electricity prices: The benefits of using isotonic distributional regression, Energy Economics 139, 107934

(doi: 10.1016/j.eneco.2024.107934). Earlier working paper version available from arXiv: https://arxiv.org/abs/2404.02270.

(doi: 10.1016/j.eneco.2024.107934). Earlier working paper version available from arXiv: https://arxiv.org/abs/2404.02270.  Julia codes available from GitHub

Julia codes available from GitHub - K.Maciejowska, T. Serafin, B. Uniejewski (2024) Probabilistic forecasting with a hybrid Factor-QRA approach: Application to electricity trading, Electric Power Systems Research 234, 110541

(doi: 10.1016/j.epsr.2024.110541)

(doi: 10.1016/j.epsr.2024.110541) - F. Petropoulos, G. Laporte, E. Aktas, S.A. Alumur, C. Archetti, H. Ayhan, M. Battarra, J.A. Bennell, J.-M. Bourjolly, J.E. Boylan, M. Breton, D. Canca, L. Charlin, B. Chen, C.T. Cicek, L.A. Cox Jr, C.S.M. Currie, E. Demeulemeester, L. Ding, S.M. Disney, M. Ehrgott, M.J. Eppler, G. Erdoğan, B. Fortz, L.A. Franco, J. Frische, S. Greco, A.J. Gregory, R.P. Hämäläinen, W. Herroelen, M. Hewitt, J. Holmström, J.N. Hooker, T. Işık, J. Johnes, B.Y. Kara, Ö. Karsu, K. Kent, C. Köhler, M. Kunc, Y.-H. Kuo, J. Lienert, A.N. Letchford, J. Leung, D. Li, H. Li, I. Ljubić, A. Lodi, S. Lozano, V. Lurkin, S. Martello, I.G. McHale, G. Midgley, J.D.W. Morecroft, A. Mutha, C. Oğuz, S. Petrovic, U. Pferschy, H.N. Psaraftis, S. Rose, L. Saarinen, S. Salhi, J.-S. Song, D. Sotiros, K.E. Stecke, A.K. Strauss, İ. Tarhan, C. Thielen, P. Toth, G. Vanden Berghe, C. Vasilakis, V. Vaze, D. Vigo, K. Virtanen, X. Wang, R. Weron, L. White, T. Van Woensel, M. Yearworth, E.A. Yıldırım, G. Zaccour, X. Zhao (2024) Operational research: Methods and applications, Journal of the Operational Research Society 75(3), 423-617

(doi: 10.1080/01605682.2023.2253852). Working paper version available from arXiv: https://arxiv.org/abs/2303.14217

(doi: 10.1080/01605682.2023.2253852). Working paper version available from arXiv: https://arxiv.org/abs/2303.14217 - P. Ghelasi, F. Ziel (2024) Hierarchical forecasting for aggregated curves with an application to day-ahead electricity price auctions, International Journal of Forecasting 40(2), 581-596 (doi: 10.1016/j.ijforecast.2022.11.004)

- G. Marcjasz, M. Narajewski, R. Weron, F. Ziel (2023) Distributional neural networks for electricity price forecasting, Energy Economics 125, 106843 (doi: 10.1016/j.eneco.2023.106843). Working paper version available from arXiv: https://arxiv.org/abs/2207.02832

- W. Nitka, R. Weron (2023) Combining predictive distributions of electricity prices. Does minimizing the CRPS lead to optimal decisions in day-ahead bidding?, Operations Research and Decisions 33(3), 103-116

(doi: 10.37190/ord230307). Working paper version available from arXiv: https://arxiv.org/abs/2308.15443

(doi: 10.37190/ord230307). Working paper version available from arXiv: https://arxiv.org/abs/2308.15443 - K. Olivares, C. Challu, G. Marcjasz, R. Weron, A. Dubrawski (2023) Neural basis expansion analysis with exogenous variables: Forecasting electricity prices with NBEATSx, International Journal of Forecasting 39(2), 884-900

(doi: 10.1016/j.ijforecast.2022.03.001). Working paper version available from arXiv: https://arxiv.org/abs/2104.05522

(doi: 10.1016/j.ijforecast.2022.03.001). Working paper version available from arXiv: https://arxiv.org/abs/2104.05522 - R. Sgarlato, F. Ziel (2023) The role of weather predictions in electricity price forecasting beyond the day-ahead horizon, IEEE Transactions on Power Systems 38(3), 2500-2511

(DOI: 10.1109/TPWRS.2022.3180119)

(DOI: 10.1109/TPWRS.2022.3180119) - M. Narajewski, F. Ziel (2022) Optimal bidding in hourly and quarter-hourly electricity price auctions: trading large volumes of power with market impact and transaction costs, Energy Economics 110, 105974 (doi: 10.1016/j.eneco.2022.105974). Working paper version available from arXiv: https://arxiv.org/abs/2104.14204

- T. Serafin, G. Marcjasz, R. Weron (2022) Trading on short-term path forecasts of intraday electricity prices, Energy Economics 112, 106125 (doi: 10.1016/j.eneco.2022.106125). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2017.html

- A. Jędrzejewski, G. Marcjasz, R. Weron (2021) Importance of the long-term seasonal component in day-ahead electricity price forecasting revisited: Parameter-rich models estimated via the LASSO, Energies 14(11), 3249

(doi: 10.3390/en14113249). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2104.html

(doi: 10.3390/en14113249). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2104.html - J. Lago, G. Marcjasz, B. De Schutter, R. Weron (2021) Forecasting day-ahead electricity prices: A review of state-of-the-art algorithms, best practices and an open-access benchmark, Applied Energy 293, 116983

(doi: 10.1016/j.apenergy.2021.116983). Working paper version available from arXiv: https://arxiv.org/abs/2008.08004

(doi: 10.1016/j.apenergy.2021.116983). Working paper version available from arXiv: https://arxiv.org/abs/2008.08004 - B. Uniejewski, R. Weron (2021) Regularized quantile regression averaging for probabilistic electricity price forecasting, Energy Economics 95, 105121 (doi: 10.1016/j.eneco.2021.105121). Working paper version available from RePEc: https://ideas.repec.org/p/wuu/wpaper/hsc1904.html

- C. Kath, W. Nitka, T. Serafin, T. Weron, P. Zaleski, R. Weron (2020) Balancing generation from renewable energy sources: Profitability of an energy trader, Energies 13(1), 205

(doi: 10.3390/en13010205). Working paper version available from RePEc: https://ideas.repec.org/p/wuu/wpaper/hsc1907.html

(doi: 10.3390/en13010205). Working paper version available from RePEc: https://ideas.repec.org/p/wuu/wpaper/hsc1907.html - G. Marcjasz, B. Uniejewski, R. Weron (2020) Beating the naive – Combining LASSO with naive intraday electricity price forecasts, Energies 13(7), 1667

(doi: 10.3390/en13071667). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2001.html

(doi: 10.3390/en13071667). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2001.html

Peer-reviewed articles in non JCR-listed journals

- …

Book chapters

- …

Conference papers

- J. Nasiadka, W. Nitka, R. Weron (2022) Calibration window selection based on change-point detection for forecasting electricity prices. In: D. Groen et al. (eds.), Computational Science – ICCS 2022, Lecture Notes in Computer Science 13352, pp. 278-284, Springer (DOI: 10.1007/978-3-031-08757-8_24). Working paper version available from arXiv: https://doi.org/10.48550/arXiv.2204.00872

- W. Nitka, T. Serafin, D. Sotiros (2021) Forecasting electricity prices: Autoregressive Hybrid Nearest Neighbors (ARHNN) method. In: M. Paszynski et al. (eds.), Computational Science – ICCS 2021, Lecture Notes in Computer Science 12745, pp. 312-325, Springer (DOI: 10.1007/978-3-030-77970-2_24). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2106.html

Forthcoming publications, submitted papers and work in progress ![]()

- J. Chen, S. Lerch, M. Schienle, T. Serafin, R. Weron (2025) Probabilistic intraday electricity price forecasting using generative machine learning, submitted. Working paper version available from arXiv: https://arxiv.org/abs/2506.00044

- G. Marcjasz, J. Lago, R. Weron (2023) Neural networks in day-ahead electricity price forecasting: Single vs. multiple outputs, work in progress. Working paper version available from arXiv: https://arxiv.org/abs/2008.08006

- G. Marcjasz, T. Serafin, R. Weron (2023) Trading on short-term path forecasts of intraday electricity prices. Part II – Distributional Deep Neural Networks, work in progress. Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2301.html

Public appearances ![]()

- International Institute of Forecasters (IIF) Distinguished Lectures on Electricity Price Forecasting, International Symposium on Energy Analytics (ISEA2025), UNC Charlotte, USA 🇺🇸, 3-4.03.2025 (for slides and Python/Julia snippets see: https://p.wz.pwr.edu.pl/~weron.rafal/Conf/IIF24)

Part I, Lecture I

Part I, Lecture II

Part II, Lecture I

Part II, Lecture II

- Catapult, Value in Energy Data series – episode #23, GBR 🇬🇧, 29.11.2023

- Applied Machine Learning Days 2022 @EPFL, Lausanne, CHE 🇨🇭, 26-30.03.2022

PostForecasts.jl in Julia (maintained by Arkadiusz Lipiecki) – a package for postprocessing point predictions to obtain probabilistic forecasts. See Lipiecki et al. (2024, Energy Economics, doi: 10.1016/j.eneco.2024.107934) and Lipiecki & Weron (2025, SoftwareX, doi: 10.1016/j.softx.2025.102200) for details.

PostForecasts.jl in Julia (maintained by Arkadiusz Lipiecki) – a package for postprocessing point predictions to obtain probabilistic forecasts. See Lipiecki et al. (2024, Energy Economics, doi: 10.1016/j.eneco.2024.107934) and Lipiecki & Weron (2025, SoftwareX, doi: 10.1016/j.softx.2025.102200) for details.- DistributionalNN in Python (maintained by Grzegorz Marcjasz) – library for training, calibrating and making predictions with distributional deep neural networks (DDNN). See Marcjasz et al. (2023; Energy Economics 125, 106843; doi: 10.1016/j.eneco.2023.106843) for details.

- NBEATSx in Python (maintained by Christian Challu) – library that extends the NBEATS model to incorporate exogenous factors (includes a notebook with examples: nbeatsx_example.ipynb). See Olivares et al. (2023; International Journal of Forecasting; doi: 10.1016/j.ijforecast.2022.03.001) for details.

- epftoolbox in Python (maintained by Jesus Lago) – the first open-access library for driving research in electricity price forecasting. Its main goal is to make available a set of tools that ensure reproducibility and establish research standards in electricity price forecasting research. See Lago et al. (2021; Applied Energy; doi: 10.1016/j.apenergy.2021.116983) for details. The accompanying market data is here: https://zenodo.org/records/

4624805

Project team meetings:

- 3rd PRIORITY Meeting (part of the CrossFIT – PRIORITY joint meeting), 26.08.2024, Satellite to INREC 2024, 27-28.08.2024.

- 2nd CrossFIT Meeting (part of the IMMORTAL – CrossFIT – PRIORITY joint meeting), 4.09.2023, Satellite to INREC 2023, 5-6.09.2023, Essen, Germany.

- 2020-2022 meetings canceled due to COVID-19.

- Kick-off meeting (part of the IMMORTAL – CrossFIT joint meeting), 24.09.2019, Satellite to INREC 2019, 25-26.09.2019, Essen, Germany.